Monday, March 30, 2009

General Growth's Future Grows Gloomier

Chicago-based General Growth, owner of the mall, did not meet a deadline to work out a deal with the holders of debt associated with the former Rouse Co, and talks continue. From WaPo:

By Dana Hedgpeth

Washington Post Staff Writer

Monday, March 30, 2009; 9:48 AM

General Growth, the huge shopping mall owner that is struggling to avoid bankruptcy and is late in its debt payments, said today that it is continuing discussions with bond holders.

The company said in a statement that it did not achieve the minimum acceptance levels for a previously announced deal, which expired Friday. Some of the company's lenders have already moved to foreclose on its properties.

General Growth, based in Chicago, has nearly $30 billion in debt. It has been trying to get loan extensions and raise cash by selling some malls. It has gotten rid of its chief financial officer and suspended its dividend. Rating agencies have downgraded its credit ratings.

Some retail analysts predict the company is teetering on declaring bankruptcy. If it does so, that would be among the largest real estate downfalls in U.S. history.

The company owns and manages more than 200 regional shopping malls in 44 states. It owns Fashion Show in Las Vegas, Water Tower Place in Chicago and Faneuil Hall in Boston. Locally, it owns Landmark Mall in Alexandria, Tysons Galleria in McLean and Laurel Commons in Laurel.

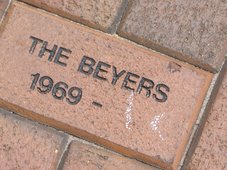

The 50-year-old company was started by the Bucksbaum brothers, who were grocers. In the real estate market's boom years, General Growth used debt to aggressively buy properties. Its biggest acquisition came in 2004 when it paid nearly $13 billion for the Rouse Co., known for creating Columbia.

By Dana Hedgpeth

Washington Post Staff Writer

Monday, March 30, 2009; 9:48 AM

General Growth, the huge shopping mall owner that is struggling to avoid bankruptcy and is late in its debt payments, said today that it is continuing discussions with bond holders.

The company said in a statement that it did not achieve the minimum acceptance levels for a previously announced deal, which expired Friday. Some of the company's lenders have already moved to foreclose on its properties.

General Growth, based in Chicago, has nearly $30 billion in debt. It has been trying to get loan extensions and raise cash by selling some malls. It has gotten rid of its chief financial officer and suspended its dividend. Rating agencies have downgraded its credit ratings.

Some retail analysts predict the company is teetering on declaring bankruptcy. If it does so, that would be among the largest real estate downfalls in U.S. history.

The company owns and manages more than 200 regional shopping malls in 44 states. It owns Fashion Show in Las Vegas, Water Tower Place in Chicago and Faneuil Hall in Boston. Locally, it owns Landmark Mall in Alexandria, Tysons Galleria in McLean and Laurel Commons in Laurel.

The 50-year-old company was started by the Bucksbaum brothers, who were grocers. In the real estate market's boom years, General Growth used debt to aggressively buy properties. Its biggest acquisition came in 2004 when it paid nearly $13 billion for the Rouse Co., known for creating Columbia.

Subscribe to:

Post Comments (Atom)

1 comment:

Short, simple, straight to the point, post. I liked reading this one.

You're on my blog roll, I was wondering if you'd add me to yours?

Post a Comment